PPO v1.0 MASP – Multi Asset Single Pool¶

the Universal Options Protocol¶

PPO v1.0 is a universal options protocol that enables the creation and trading of options or other derivatives from any type of underlying asset based on the collateral held in liquidity pools. Our mechanism is universal, in the sense that it provides both universal support for any underlying assets, as well as universal support for a variety of innovative models for options issuance.

PPO v1.0’s pooled liquidity enables users to buy options directly through the protocol smart contract without individual counterparties. In the current construction of PPO v1.0, a separate liquidity pool must be maintained on each respective chain.

There is no limit to the types of options that can be created with the protocol. Any asset can be an underlier for PPO options — including cryptocurrencies from any blockchain, fiat currencies, commodities, equities, and practically any asset with a reliable on-chain price feed. Under this version of our protocol, it is not necessary for assets to exist in a tokenized form on-chain. The options are synthetically derived from an oraclized price feed itself.

The basic call/put options introduced with v1.0 serve as a foundation for many other combinations of options strategies (straddles, strangles, etc.). PPO users will be able to create their own unique portfolio tailored to their individual risk/return requirements. As we expand the number of assets included, these tools will become increasingly useful in creating bespoke strategies.

How Does the Liquidity Pool Work in PPO v1.0?¶

The unique MASP system — Multi-Asset Single-Pool — allows the users to gain exposure to a variety of bespoke cash-settled options positions on a variety of underlying assets, like BTC and ETH. More underlying assets are likely to be added in the future.

The following graphic describes the different roles in the pooled system — Options Buyers and Pool Participants (LPs) — as well as the different actions — selling, exercising, and contributing or withdrawing collateral assets.

Pooled Options Model Basics¶

-

PPO v1.0 will be live on multiple chains with the same mechanisms.

-

Collective liquidity/collateral pools are created with collateral assets. The pools then act as the seller of all the options. The protocol may accept other crypto assets as collateral for the pool in later versions and/or on different blockchains.

-

Options will not be tokenized. Rather they will be recorded in smart contracts.

-

The initial underlying assets are BTC and ETH, but can be extended to any assets. The long-term vision includes the creation of bespoke options positions on any cryptocurrency, stock, physical assets, index or really any asset with a dynamic price feed.

-

Options will be American type and can be exercised any time freely before expiration against the single liquidity pool on the chain where the exposure is held. Some restrictions may be understandably added in the first few iterations here to control risks. For example, a one-hour chill time restriction is added.

-

Pool shares are tokenized as PPT tokens and sent to pool participants as certificates.

-

The pool size is measure by the net value in USD, which changes according to the distribution of premiums, moneyness of options, exercising, sell-back, and other associated features.

-

The buyers can choose option characteristics according to their needs. The associated premium will be calculated using algorithms in the smart contracts, dynamically and automatically.

-

Protocol security will be maintained by setting the collateral level high to guard against black swan events. The collateralization ratios for stablecoins are set to be 120%.

-

Collateral assets in the pool can be withdrawn anytime, provided the liquidity is not fully locked by the existing option contracts. Again, some restrictions may be added in the first version. For example, a one-hour chill time restriction is added.

PPO v1.0 MASP Pool Overview¶

MASP stands for Multi-Asset-Single-Pool. It is the core mechanism applied in Phoenix’ decentralized peer-to-pool options protocol, with liquidity pools as the counterparty for writing and settling option contracts.

'Multi-Asset' features in the liquidity pools enable the creation and trading of options from any type of underlying asset, including crypto assets, commodities, fiats, stocks, indexes, and more. The potential for underliers is unlimited.

'Multi-Asset' also means that there can be multiple types of crypto assets in the liquidity pool. For instance, PPO v1.0 has a hybrid stablecoin pool including USDC, USDT as the currencies for settlement. It may develop with more assets by this 'Multi-Asset' feature.

'Single-Pool' does not mean that there is only one pool in PPO v1.0. While one liquidity pool may power many different options contracts. Liquidity can be shared automatically, different from the traditional order books.

Notice also that the MASP (Multi-Asset Single Pool) pools in the PPO are very different from liquidity pools on other DeFi platforms like Uniswap, Curve or Balancer. These two, in particular, behave as automated market makers for cryptocurrency swaps. MASP Liquidity powered by collateral tokens is a liquidity solution for both the creation and settlement of options contracts, acting as the collective options seller.

The unique MASP system allows the users to gain exposure to a variety of bespoke cash-settled options positions on a variety of underlying assets.

Pools as Collateral¶

One typical requirement of options contracts is that the seller has the obligation to perform if exercise of the option is triggered by the holder. Thus, when writing options, there must be enough collateral (margin) locked up within the smart contract to ensure that it will be settled accordingly. The MASP liquidity pools operate as collective collateral.

Pools as Trading Counterparty¶

Some DeFi options projects have experimented with different liquidity solutions for options, like order books or the DeFi-inspired method of using Uniswap AMM pools.

However, both mechanisms face issues. In the former case, traditional order books are inefficient and it can be expensive to maintain a sufficient liquidity depth while also adhering to decentralization principles. In the latter case, it is likely that the pool participants will suffer from impermanent loss due to the inherent time decay of the value of options.

The Phoenix MASP liquidity solution provides a cost-effective and capital-efficient solution for trading DeFi options in a decentralized manner. The collective pools serve as the trading counterparties for options transactions and settlements.

Pools Administered by Smart Contracts¶

Options exposure sold to options buyers will earn options premiums. These premiums will automatically accrue in the liquidity pools and, as premiums compound over time, they are administered by smart contracts.

Since this pool is the counterparty for all live options, including all puts and calls with various underlying assets at different strike prices and expirations, the risk from any single option contract is diluted by the depth of the pool.

In addition, DeFi’s open-source nature ensures that the operations in the pools are censorship-resistant and publicly on-chain. In this regard, they are completely different from the black boxes some pools turn out to be in traditional finance.

The MASP automatic mechanism provides greater efficiency and encourages users to participate in trading as options writers.

The Net Value of the Liquidity Pool¶

Contributors that deposit their tokens in pools will receive PPT tokens that track a pro-rata share of their ownership in the options liquidity pools. As such, it is important to understand how the value of those tokens is calculated.

What Is Pool Net Value?¶

The Pool Net Value measures the monetary value of all the options exposures currently in the liquidity pool. It is calculated on the basis of accrual accounting and, as a result, may not be equal to the sum of actual net inflows and outflows at a given time.

Potential gains and losses to the liquidity pool, as the counterparty to the collective value of all options exposure sold from the pool, are reflected in changes to the Pool Net Value. In PPO, Pool Net Value is an important concept in deciding the pool size, which in turn determines the maximum value of options that can be written on the market, and, at the same time, measures the value of potential user claims from the pool.

What Affects Pool Net Value?¶

Let us take the USDC pool for example. (The other liquidity pools follow the same principles as described below.)

The total Pool Net Value (PNV) in USD is affected by the following factors:

- USDC deposits increase the PNV;

- USDC withdrawals decrease the PNV;

- Receiving option premiums increases the PNV, with the caveat that the premiums accrue to the PNV over time as the options within the pool move towards maturity. This accrual mechanism is explained in more detail below;

- The change in the intrinsic value of options (otherwise known as the “moneyness” level) increases or decreases the PNV. If an option goes further in the money, the intrinsic value is higher and benefits option holders. Hence, the PNV would decrease. If the option goes further out of the money, the intrinsic value of the options exposure printed by the pool would be lower and thus the PNV would be higher because the pool, acting as counterparty, would have reduced obligations;

- Exercising options leads to a cash settlement that decreases PNV;

- Selling options to the pool allows options holders to receive consideration from the pool and leads to the termination of the options contract, which in turn decreases PNV; (Currently disabled in v1.0)

- The change in USD value of the USDC token increases or decreases PNV.

Calculating Pool Net Value¶

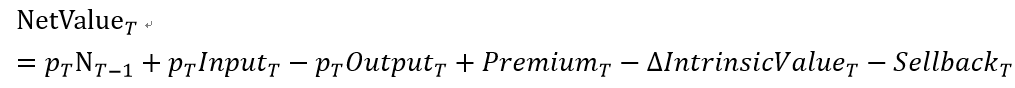

With the principles above, we can put the Pool Net Value (PNV) at the time of T as NetValue_T into the following formula:

Where,

-

p(T) is the USD price of USDC at the time of T.

-

N(T-1) is the number of USDC in the pool at the time of T-1.

-

Input(T) is the number of USDC tokens that are input into the pool during the time between T-1 and T.

-

Output(T) is the number of USDC tokens that are withdrawn out of the pool during the time between T-1 and T.

-

Premium(T) is the USD amount of premium that should be distributed into the pool, during the time between T-1 and T. Please check the details of calculation in the ‘Options Premium Distribution’ section below.

-

△IntrinsicValue(T) is the change of the intrinsic value of the existing options and the options that get exercised during the time between T-1 and T.

-

Sellback(T) is the USD value of the options that are sold back to the pool by the option holders during the time between T-1 and T. (Currently disabled in v1.0)

Options Premium Distribution¶

As mentioned above, Premium(T) is the measurement of premium distribution during the time between T-1 and T. In particular, we need to highlight the unique method utilized in the PPO to distribute options premiums to liquidity providers over time.

As consideration for the right given to option holders, premiums are paid into the pool all at once, at the time of purchase. However, due to the nature of all options contracts, that they are valid within a certain period of time until expiry, and based upon the accrual method of accounting, the options pool itself should not book the premium income all at once, either at the time of purchase or expiration. The premium, therefore, must be distributed into the pool in line with the level of seller obligations as time moves closer to expiry, or as the ratio of the time value of options decays with time.

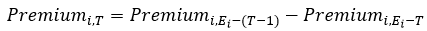

Therefore, at time T, the premium of an option distributed into the pool is calculated as

Where E(i) is the expiration of the option ‘i’, and Premium(i, Ei-T) refers to the premium of an option, calculated by the Black-Scholes model, with exactly the same terms and parameters as the option ‘i’, but with a different expiration of E(i)-T.

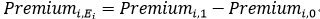

The difference in the above formula is the time decay of the value of the option ‘i’ as the time moves from T-1 to T, which should be accrued into the pool. When T=E(i), it means the time moves to the expiration time, and the premium in the last time slot will be fully distributed, where

Premium(i,0) means the option i goes to expiration, and it is the same as the intrinsic value.

What if the options are sold back to the pool or exercised during the time period T-1 to T?

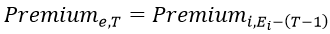

Then the options will cease to exist after the time T, and the obligations of the option sellers will be gone. Hence the seller, which in this case is the monolithic liquidity pool itself, will be fully entitled to the premium not distributed before. Afterward, the rest of the unaccrued premiums will be allocated all at once. At time T, the premium of an option ‘e’, that is sold back or exercised, distributed into the pool is calculated as:

Note that the selling-back function currently disabled in PPO v1.0.

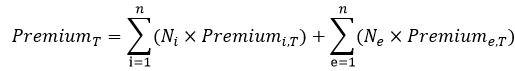

Therefore, the Premium (T), the USD amount of premium that should be distributed into the pool, during the time between T-1 and T, can be calculated as:

Where N is the number of the equivalent options.

The Net Value of the Pool Share Token (PPT)¶

Following the previous USDC pool example, after a user puts USDC tokens into the pool, the USDC will be collateralized, and the holders will be entitled to the benefits of having a fraction of the liquidity pool. A pool share token will be minted and delivered to the users, to represent the pro-rata share in the USDC options pool.

The pool share token is called PPT, which stands for Phoenix Pool Share Token. PPT is transferable.

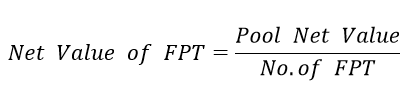

The net value of PPT is calculated using the Pool Net Value (defined above) and dividing by the total number of PPT tokens.

Liquidity Pool Operations¶

Entering the Liquidity Pool¶

Any users holding collateral assets can participate in the liquidity pool, getting option premiums and other returns, by depositing collateral assets into the pooling smart contract. A simple UI is designed for users to make inputs and interact with the smart contract. PPT tokens will be minted and delivered as pool share certificates.

The number of PPT tokens one may get is determined by the value of asset input into the pool in USD, and the net value of PPT at the time of depositing:

No.of PPT=(Assets input in USD)/(Net Value of PPT)

For example, if the Net Value of PPT is 1.5 USD, by depositing $150 worth of USDC, one may get 100 PPT in return.

Exiting the Liquidity Pool¶

Pool participants may exit the Liquidity Pools at any time, provided the collateral in the pool is not fully utilized and the collateral utilization ratio is over the Minimum Collateralization Ratio (MCR).

In cases when the collateral utilization ratio is below the Minimum Collateralization Ratio (MCR), pool withdrawal will be paused. The liquidity pool will also cease to write new option contracts until the collateral utilization ratio recovers to be above the MCR level.

By simply pressing the withdraw button, pool participants may withdraw the collateralized crypto assets partly or in full out of the pool. This operation will burn the related PPT tokens and the equivalent amount of crypto assets in the pool will be delivered at the net value of PPT at the time of withdrawal. Notice that in hybrid pools, the withdrawal is done proportionate to the composition of assets in the pools.

After withdrawal, the pool net value and the collateral utilization ratio will change accordingly.

Liquidity Pool Security (Collateralization)¶

In traditional finance, the performance of an options contract is ensured by the centralized third-party custody solutions that regularly compel and enforce the maintenance of sufficient collateral deposited from the options seller.

On a DeFi options platform, with the help of decentralized smart contracts, the seller/writer of options can deposit and collateralize a certain amount of margin - the collateral - in the smart contract to automatically ensure the exercise and performance of the option contract.

In the MASP options model of PPO v1.0, the liquidity pool acts as the only collective counterparty for all options. Pool participants each own a fraction of the total liquidity. Therefore, maintaining the security of the liquidity pool as a whole is crucial to making sure that the issued options are always fully backed. In other words, the collateralization ratio of the pool should be high enough to safeguard against massive market movements and other black swan events.

The minimum collateral ratio of stablecoins in the liquidity pools is set at 120% .

However, in accordance with the essence of DeFi’s experimental nature, this threshold may be raised or lowered in the future in accordance with user response and the robustness of the protocol.

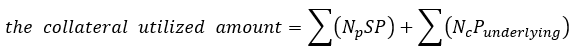

Collateral Ratio=(total collateral value)/(the collateral utilized amount)

The collateral ratio is calculated as the ratio of the total collateral value over the amount of collateral used to back options exposure written. The utilized amount is the total USD value of the strike assets in the live options. For one put option, the utilized amount is the strike price in USD. For one call option, the utilized amount is the current price of the underlying asset in USD.

where N(c) is the number of call options; N(p) is the number of put options; SP is the strike price; P(underlying) is the current price of the underlying asset.

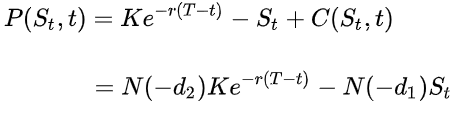

Options Pricing¶

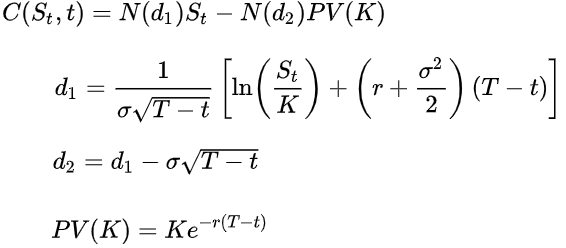

Options in PPO v1.0 are priced according to the Black-Scholes Option Pricing Model. The pricing mechanism is coded in the smart contracts.

The value of a call option is:

The price of a put option based on put-call parity is:

For both, as above:

N(·) is the cumulative distribution function of the standard normal distribution;

T-t is the time to maturity;

S is the spot price of the underlying asset;

K is the strike price;

r is the risk-free rate;

σ is the volatility of returns of the underlying asset.

When buying and selling options on PPO v1.0, the options are priced according to the Black-Scholes formula implanted in the smart contracts. Key parameters for pricing options include asset price feeds and Implied Volatility (IV).

In order to make the pricing mechanism more dynamic, an additional adjustment coefficient is added to the pricing formula to make the pool more balanced with regard to risk. The adjustment coefficient is subject to change according to the puts/calls ratio on the market and the overall utilization of the pool. The coefficient will behave in a manner that dynamically makes the calls/puts more expensive, if there are more calls/puts issued and backed by the collateral pool.

The Options Market¶

Buying Options¶

By purchasing call options, you are taking advantage of leverage, allowing you to use less money to gain positive exposure to the price of the underlying assets.

By purchasing put options, you are buying protection or insurance, to protect yourself against potential price drops of the underlying asset. Essentially, you are betting against an increase in the token price.

The trading venue is created automatically with the pooled liquidity.

When buying options, the pool collectively acts as the seller/writer; when a holder exercises options, the pool is the settler. There is no need to wait for orders to be filled, as is the case with traditional order books. The liquidity for all options is concentrated in the related liquidity pool.

This mechanism solves the liquidity and slippage issues experienced by most centralized exchanges.

Customizable Options¶

A clear benefit to options buyers in PPO v1.0 is that they can choose the terms of the options at their own discretion. They can create their own bespoke option by choosing option type, strike price, or expiration date. Option buyers can buy in-the-money (ITM), out-the-money (OTM), or at-the-money (ATM) calls and puts, with shared liquidity.

One can choose an options strategy that best suits one’s own unique individual risk profile, and may further combine it with different options or other derivatives, to create complex investment portfolios.

Exercise an option¶

Options in PPO v1.0 are all American types. Once a buyer purchases an option and becomes the holder, he/she may exercise the options, partly or fully, any time before expiration, but only after chill-time has passed since the purchase.

Notice that in hybrid pools, the assets on may get by exercising options are settled proportionate to the composition of assets in the pools. For example, in USDC/USDT hybrid pools, one may get a combination of USDC/USDT coins by exercising an option contract.

When Can I Exercise?¶

Options in PPO v1.0 are all American type options and, as such, can be exercised anytime before expiration.

Should I Exercise?¶

It is entirely up to the holder of the options whether or not and when to exercise an option. Whether it is financially beneficial for the option holders to exercise comes down to personal choices. The system of oracles and smart contracts that comprise PPO v1.0 will not make this decision on behalf of options holders.

What Happens When I Exercise My PPO Option?¶

Phoenix options will be cash-settled, denominated in PHX tokens, which means that only the difference in price will be settled. The difference between the strike price and the market value of the underlying asset will be exchanged into the collateral assets via smart contracts and transferred into the option holder’s address.

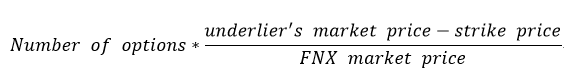

When exercising, if a call option is in the money, the option token holder will get the following amount from the liquidity pool:

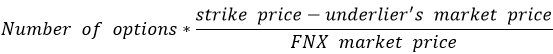

If a put option is in the money, the option token holder will get the following amount from the liquidity pool when exercising:

The same logic applies to other liquidity pools.

When more than one type of crypto assets are collateralized in the pool, a combination of these assets, proportionate to the composition of the liquidity pool, will be settled and delivered to the holder’s address.

Fees¶

PPO v1.0 currently charges 5% of the total premium as transaction fee from the option buyers, and 5% of the cash settlement as settlement fee from the option holders when exercising options.

Oracles and Price¶

All values of the crypto assets, including both the collateral assets and underlying assets, will be calculated and measured in US dollars.

Phoenix Finance has integrated Chainlink’s Price Feeds to power our PPO platform.