Introduction

Introduction¶

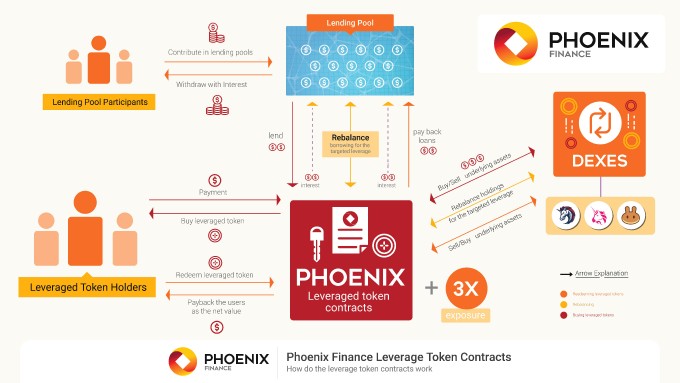

The Phoenix Protocol for Leveraged Tokens (PPLT) v1.0 is a decentralized and non-custodial protocol for creating and trading decentralized leveraged tokens, which are powered by lending pools. The protocol is accessible through a joint interface that supports multiple blockchains.

Phoenix’s Leveraged Tokens give holders leveraged exposure to cryptocurrency markets, without having to worry about actively managing a leveraged position. The rebalancing mechanism maintains the holders’ leverage exposure at a fixed level, no matter how the underlier’s price moves. Therefore, token holders will never get liquidated - a key difference compared to trading on margin or using perpetuals.

Phoenix leveraged tokens are asset-backed tokens, NOT synthetic assets. They always have 100% collateralization, in collaboration with other decentralized exchanges. Real cryptoasset borrowing and transactions are conducted through smart contracts to back the value of the tokens. Thanks to the on-chain rebalancing mechanism, a leverage range close to 3x is maintained for the holders. Anyone can monitor and verify the collateral and leveraged positions embedded in the tokens at any time in a transparent way.

Lending pools power the tokens’ leverage. When leveraged tokens are created, they automatically borrow an equivalent amount of cryptoassets from the pools, and trade to get leveraged exposure. Pool participants will earn passive interest returns.

Basic Modelling Structure¶