How to Trade Options with Phoenix Finance¶

Phoenix Finance allows users to trade options based on a variety of underliers using an innovative pooled liquidity mechanism that maximizes the efficiency of liquidity, spreads risks and shares premiums among options writers.

Phoenix Finance allows users to trade options based on a variety of underliers using an innovative pooled liquidity mechanism that maximizes the efficiency of liquidity, spreads risks and shares premiums among options writers.

But how do you actually trade these potentially lucrative contracts? Here is a short, hands-on guide from the Phoenix team.

Step 1¶

First of all, you have to navigate to the Phoenix homepage. Here, navigate to the “Launch App” button on the top right and click on it. Then select the product you would like to access. For the purpose of this guide, please click on “options”.

Or you may just check on the app UI and navigate to the options section.

Step 2¶

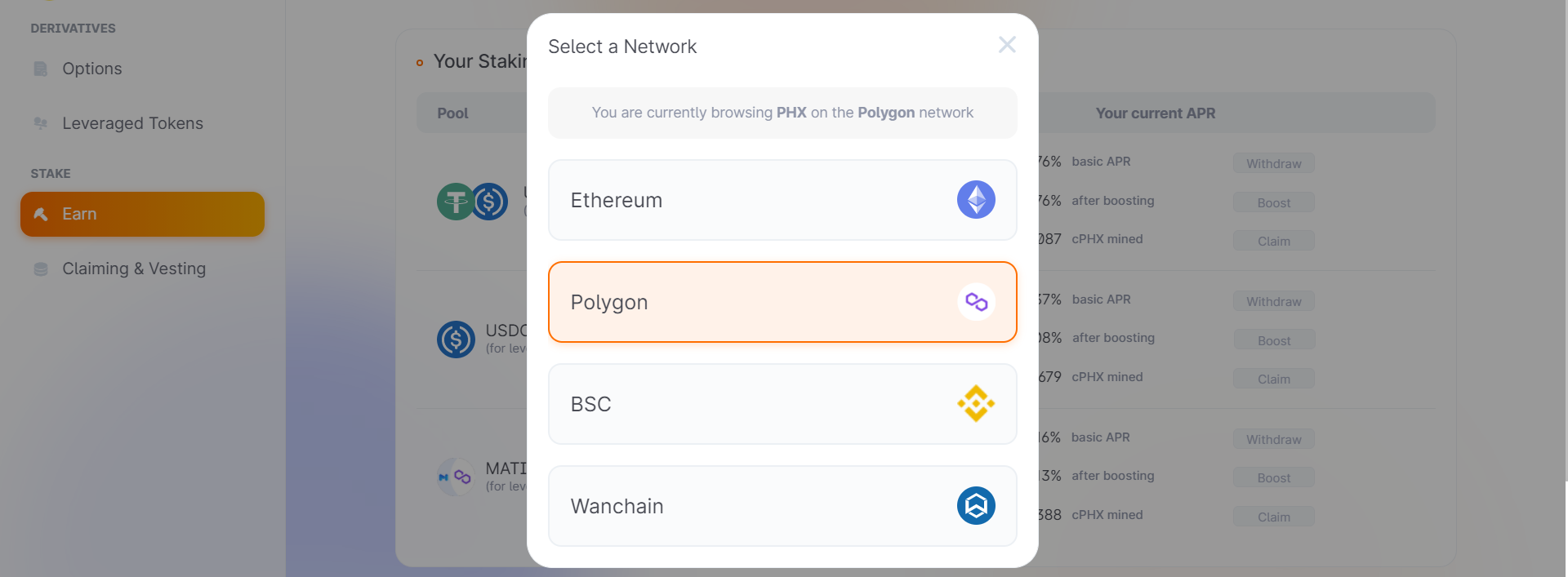

Now choose the blockchain you would like to rely on to trade.

Step 3¶

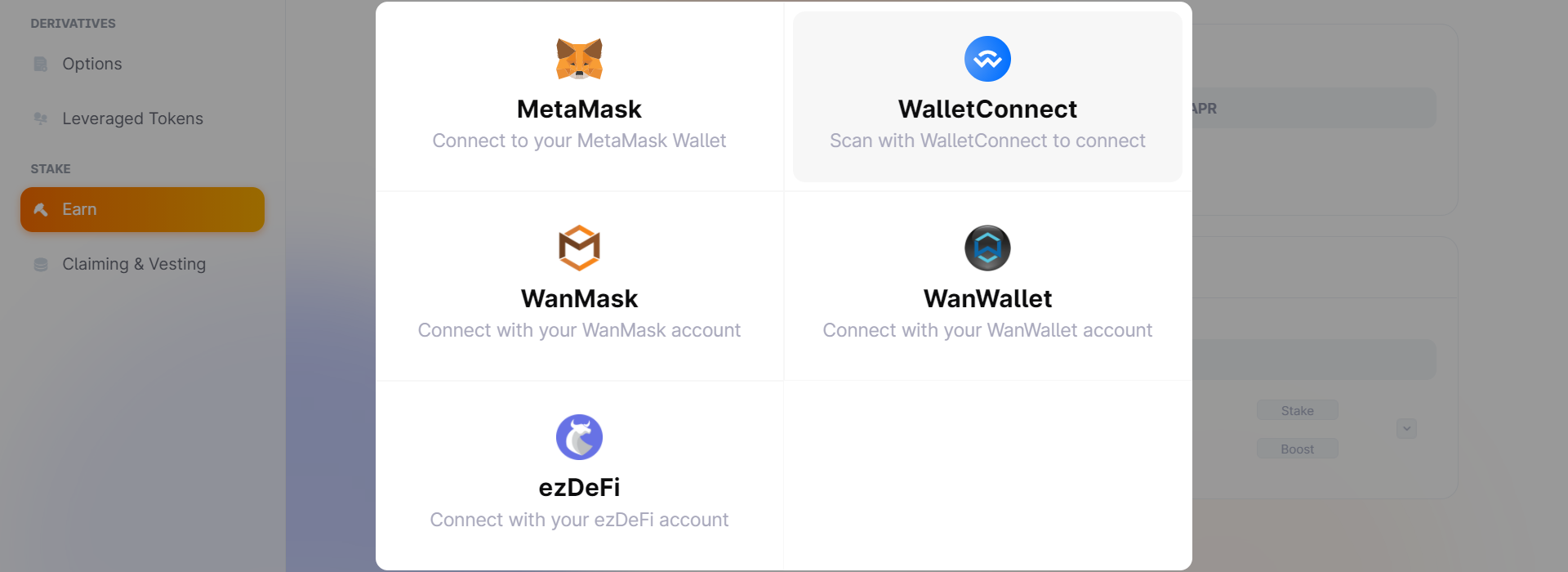

In order to start trading, you must first connect a wallet. At present, we support Metamask, WalletConnect, WanMask, WanWallet and ezDeFi. More will be added in the future.

Click on “Connect Wallet” on the top right of the screen to link your funds to Phoenix.

Step 4¶

Once you have added the appropriate wallet, you can set the asset you would like to use as an underlier. As this guide is being written, they include BTC and ETH. Just click on the button on top of “Call”.

Step 5¶

You can now set the parameters for your options. First of all, however, you will need to choose which token you will use to fund your trade. You can do so from the button marked as “Pay With”.

Phoenix Finance does not need you to actually own a specific coin, as the underlier, to trade an options contract based on it. Thanks to our pooled liquidity system, you only need USDT and/or USDC (BUSD on BSC) to be able to be exposed to the volatility and potential gains associated with the assets listed.

Step 6¶

You must now select the appropriate parameters for your options, (if you are not clear with the options terms, please go here for more details), starting with whether you would like to buy a call or put option, then input the size of the contract you’d like to purchase and the strike price. This is the price at which you can exercise the options, or be more specific when the options move “in the money”. If an options contract does not reach the selected strike price, it will expire worthlessly.

You will then need to select an expiration date — the day on which your contract will cease to be exercisable. Please notice that the farther away from the expiration date, the more expensive the premium on the option will be. This is because over a longer period of time there are more chances that the options contract will move into the money and therefore sellers will demand a higher premium.

The cost of your contract will be displayed here, both in your selected token and in its equivalent in US dollars.

You have now bought your first Phoenix options contract. Congratulations and may the markets grant you a profitable result.

Step 7¶

You can exercise ‘in-the-money’ options from here at any time before expiration, by clicking the ‘exercise’ button in the ‘Your Options’ section.

If you need more information, do not forget to follow us on our social media channels.